Depreciation Life For Home Office . finance your business. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. calculating your expenses. How to figure the depreciation percentage on a home for business. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. If you qualify for the home office deduction and you own your home,. Hence, the balancing allowance of $500. the home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form. claiming home office depreciation.

from www.fastcapital360.com

Hence, the balancing allowance of $500. calculating your expenses. If you qualify for the home office deduction and you own your home,. finance your business. How to figure the depreciation percentage on a home for business. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Indirect business expenses of operating the home and allocating them on form. claiming home office depreciation. the home office deduction is computed by categorizing the direct vs. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with.

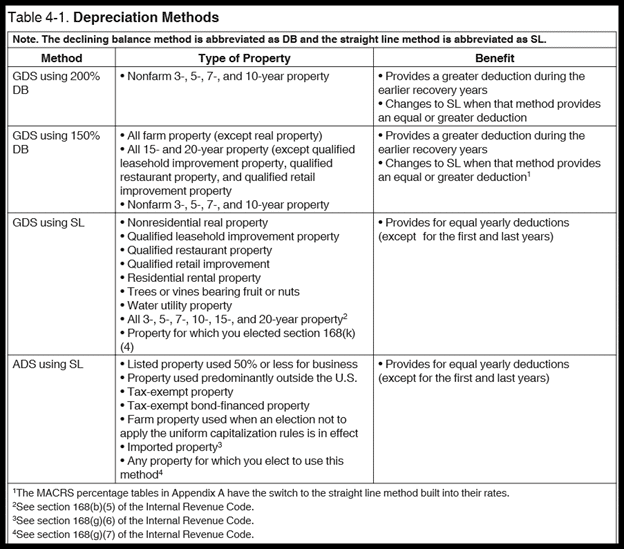

How to Calculate MACRS Depreciation, When & Why

Depreciation Life For Home Office How to figure the depreciation percentage on a home for business. claiming home office depreciation. the home office deduction is computed by categorizing the direct vs. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. Hence, the balancing allowance of $500. finance your business. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. How to figure the depreciation percentage on a home for business. If you qualify for the home office deduction and you own your home,. calculating your expenses. Indirect business expenses of operating the home and allocating them on form.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Depreciation Life For Home Office Indirect business expenses of operating the home and allocating them on form. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. the home office deduction is computed by categorizing the direct vs. How to figure the depreciation percentage on a home for business. Hence, the balancing allowance of $500. finance. Depreciation Life For Home Office.

From dxoloqxfn.blob.core.windows.net

Real Estate Depreciation Life at Donald Smith blog Depreciation Life For Home Office Hence, the balancing allowance of $500. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. If you qualify for the home office deduction and you own your home,. How to figure the depreciation percentage on a home for business. finance your business. depreciation is the systematic allocation of the depreciable. Depreciation Life For Home Office.

From dxoaerbpc.blob.core.windows.net

Standard Depreciation Rate For Office Equipment at Peggy Nisbet blog Depreciation Life For Home Office your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. Hence, the balancing allowance of $500. Indirect business expenses of operating the home and allocating them on form. the home office deduction is computed by categorizing the direct vs. claiming home office depreciation. If you qualify for the home office deduction. Depreciation Life For Home Office.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Depreciation Life For Home Office Hence, the balancing allowance of $500. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. the home office deduction is computed by categorizing the direct vs. calculating your expenses. If you qualify for the home office deduction and you own your home,. claiming home office depreciation. Indirect business expenses. Depreciation Life For Home Office.

From bronsonequity.com

2023 Multifamily Depreciation Changes Bronson Equity Depreciation Life For Home Office How to figure the depreciation percentage on a home for business. Hence, the balancing allowance of $500. Indirect business expenses of operating the home and allocating them on form. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. claiming home office depreciation. the home office deduction is computed by categorizing. Depreciation Life For Home Office.

From dxohtchnc.blob.core.windows.net

Depreciation For Office In Home at Nicole Alleyne blog Depreciation Life For Home Office Indirect business expenses of operating the home and allocating them on form. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. If you qualify for the home office deduction and you own your home,. How. Depreciation Life For Home Office.

From raninasinowiwik.blogspot.com

chasing broken dreams quotes Depreciation Life For Home Office If you qualify for the home office deduction and you own your home,. claiming home office depreciation. the home office deduction is computed by categorizing the direct vs. How to figure the depreciation percentage on a home for business. Hence, the balancing allowance of $500. calculating your expenses. Indirect business expenses of operating the home and allocating. Depreciation Life For Home Office.

From dxoenpeuk.blob.core.windows.net

How Many Years Does Hvac Depreciation at Leonard Oconnell blog Depreciation Life For Home Office depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. the home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form. How to. Depreciation Life For Home Office.

From exornobqm.blob.core.windows.net

Depreciation Rate Office Desk at Ann Chan blog Depreciation Life For Home Office calculating your expenses. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Hence, the balancing allowance of $500. If you qualify for the home office deduction and you own your home,. Indirect business expenses of operating the home and allocating them on form. claiming home office depreciation. finance your. Depreciation Life For Home Office.

From youngandtheinvested.com

MACRS Depreciation Table Guidance, Calculator + More Depreciation Life For Home Office How to figure the depreciation percentage on a home for business. claiming home office depreciation. Indirect business expenses of operating the home and allocating them on form. finance your business. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. If you qualify for the home office deduction and you own. Depreciation Life For Home Office.

From www.infocomm.ky

What Is Depreciable Property? Depreciation Life For Home Office claiming home office depreciation. How to figure the depreciation percentage on a home for business. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. If you qualify for the home office deduction and you own your home,. Hence, the balancing allowance of $500. finance your business. the home office. Depreciation Life For Home Office.

From www.examples.com

Depreciation Schedule 6+ Examples, Format, How to Build, Pdf Depreciation Life For Home Office Indirect business expenses of operating the home and allocating them on form. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. the home office deduction is computed by categorizing the direct vs. calculating your expenses. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your. Depreciation Life For Home Office.

From hxentbteo.blob.core.windows.net

Home Office Furniture Depreciation Rate at Jerry Obrien blog Depreciation Life For Home Office Indirect business expenses of operating the home and allocating them on form. Hence, the balancing allowance of $500. the home office deduction is computed by categorizing the direct vs. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. depreciation is the systematic allocation of the depreciable amount of an asset. Depreciation Life For Home Office.

From www.pinterest.com

How To Use A Home Depreciation Calculator property, Miami real Depreciation Life For Home Office depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. calculating your expenses. Hence, the balancing allowance of $500. How to figure the depreciation percentage on a home for business. finance your business. If you qualify for the home office deduction and you own your home,. your deduction of otherwise. Depreciation Life For Home Office.

From livlyt.com

Understanding & Calculating Depreciation for Electronics LivLyt Depreciation Life For Home Office claiming home office depreciation. How to figure the depreciation percentage on a home for business. calculating your expenses. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. the home office deduction is. Depreciation Life For Home Office.

From dxohtchnc.blob.core.windows.net

Depreciation For Office In Home at Nicole Alleyne blog Depreciation Life For Home Office How to figure the depreciation percentage on a home for business. finance your business. Indirect business expenses of operating the home and allocating them on form. calculating your expenses. your deduction of otherwise nondeductible expenses, such as insurance, utilities, and depreciation of your home (with. depreciation is the systematic allocation of the depreciable amount of an. Depreciation Life For Home Office.

From iteachaccounting.com

Depreciation Tables Depreciation Life For Home Office the home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form. calculating your expenses. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. claiming home office depreciation. finance your business. Hence, the balancing allowance of $500.. Depreciation Life For Home Office.

From www.youtube.com

How Bonus Depreciation Can be Used for Your Rental Properties YouTube Depreciation Life For Home Office depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. claiming home office depreciation. finance your business. If you qualify for the home office deduction and you own your home,. Indirect business expenses of operating the home and allocating them on form. How to figure the depreciation percentage on a home. Depreciation Life For Home Office.